The amendments of the MARPOL convention on sulphur oxide limits shall apply from 1st January 2020 and could be a new risk for financial markets and the economy.

What is MARPOL?

The International Convention for the Prevention of Pollution from Ships adopted in 1973 is the main international convention covering prevention of pollution of the marine environment by ships from operational or accidental causes. Its Annex VI (together with the convention dated 1973 as amended, « MARPOL »), which deals more specifically with the rules relating to atmospheric pollution from ships, has been adopted in 1997 and has entered into force in 2005.

What is exactly the sulphur oxide limit and what is its scope?

MARPOL currently (and since 2012) sets a 3.50% m/m (mass by mass) limit on sulphur oxide and nitrogen oxide emissions from ship exhausts (in other areas than designated “emission control areas” such as the Baltic Sea and the North Sea, where a 0.10% m/m limit already exists since 2015). On 1st January 2020, the 3.50% m/m limit shall be replaced with a new limit of 0.50% m/m (in other areas than designated “emission control areas”). This limit encompasses all “fuel oil used on board” with limited exemptions (e.g. situations invoking the safety of the ship or saving a life at sea, or to conduct trials for the development of the ship emission reduction). All ships are included in the scope of the new limit, whatever their size.

Is this deadline firm and final?

The new limit shall apply from 1st January 2020 and no postponement is envisaged by the IMO, which already had examined the opportunity to set a later deadline but based its choice on an assessment of the refinery capacity and therefore of the availability of fuel oil with the required quality. In addition, considering the two-year period before any proposition of amendment to the date of effect could enter into force, it is now too late for such an amendment.

What are the operational solutions to meet the new sulphur oxide limit?

Ships have broadly four solutions to comply with the lower Sulphur oxide limit:

using low-sulphur compliant fuel oil;

- using gas as a fuel (which implies lower sulphur oxide emissions when ignited);

- using methanol;

- using an equivalent method, such as exhaust gas cleaning systems or “scrubbers”, if such method has been approved by the administration of the ship’s flag State.

Why could this be a new risk for financial markets and the economy?

As the low-sulphur compliant fuel oil is more expensive, shipping will bear the extra costs of IMO 2020 (especially through the “bunker adjustment factor” used to adapt the shipping prices to fuel cost). The installation of scrubbers has been the chosen solution to reduce Sulphur emissions, by January 1st 2020, by companies such as MSC or Maersk but the high cost and especially delays might leave an important number of ships needing to shift from HSFO (High Sulphur Fuel Oil) to MGO (Marine Gas Oil) in order to remain compliant. Along this problem comes a number potentially serious impacts for the oil market as a whole, trade finance activities and the equity market.

Oil market

Gulf Coast HSFO has seen some recent volatility in the past few months with prices ranging from $50 to $65 a barrel. This volatility may be explained by a combination of macroeconomic factors, such as the recent strike against Saudi Aramco which sent prices soaring up 14.6% on Monday September 16th. Although the market has allegedly priced in the new regulation already, its impact, if underestimated, could pull the price of HSFO down below $30 a barrel with a spread against MGO taking a steep climb depending on the magnitude of the shift. Indeed, supply for scrubbers already sees between three to six month delays due to the high demand in the industry; the International Energy Agency anticipates that shipping’s demand for the product will drop to about 1.4 million barrels a day in 2020, down from 3.5 million this year.

Because demand for MGO might see the equivalent temporary shift in its favor, supply and demand

economics for refined oil products could cause prices to climb significantly with impacts on automotive fuel prices and jet fuel prices.

As a whole, the global oil industry could see significant volatility during the first half of 2020 before prices stabilize.

Trade finance

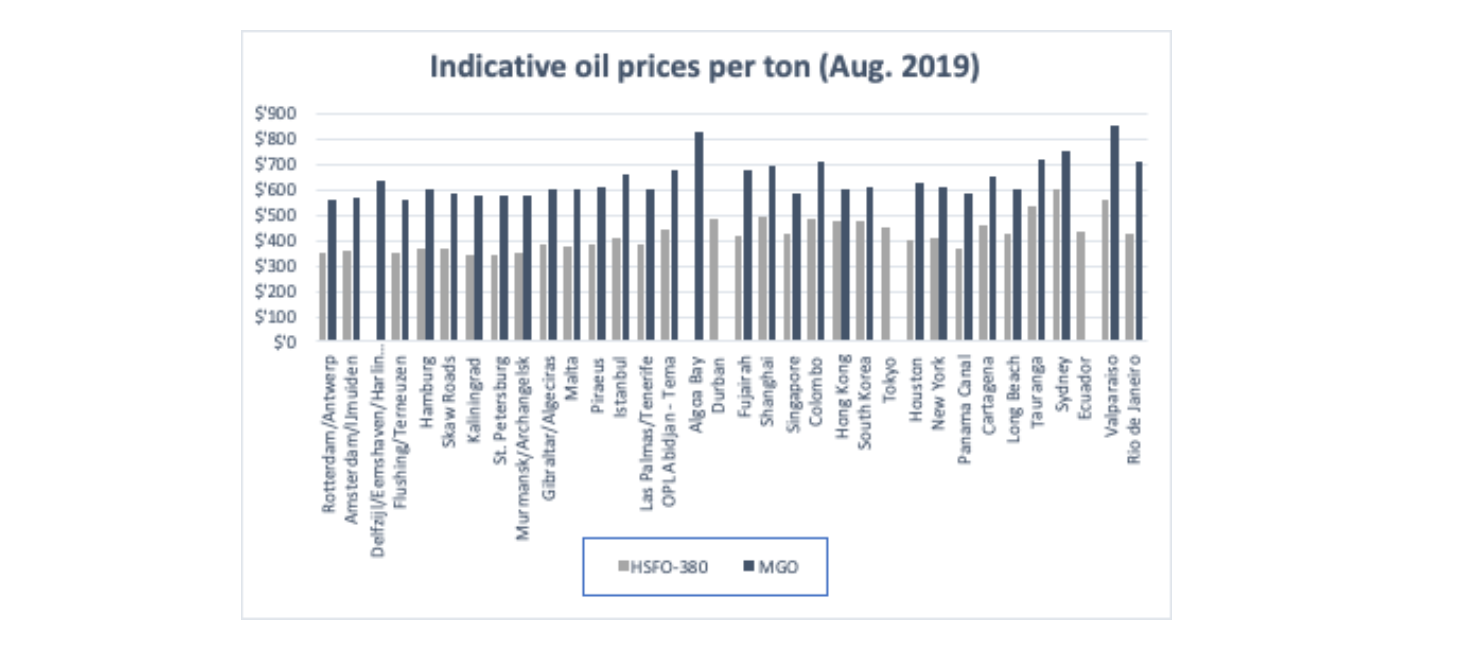

With increased fuel costs, freight prices will most certainly rise. Consequences of such hikes would also slow down global trade as import/export costs would rise. Indeed, as seen in the chart above, MGO prices are on average 52% higher than HSFO. Freight indexes such as the Baltic Dry Index have almost doubled in value over the past 3 months; and, although freight prices have increased over factors such as reductions in capacity by shipping companies’ due to trade imbalances such as in Australia, trade wars between China and USA, the costs for purchasing and installing scrubbers may have also contributed to the climb. That rise is likely to continue until mid-2020 as scrubbers are being installed and unequipped ships shift to MGO as their primary fuel.

Thus, depending on the ability export/import companies will have to absorb higher freight prices, trade finance activities may either see a lower volume of deals or significantly higher needs. Banks will therefore need to revise their internal ratings and counterparty risks because higher capital needs and increased lines of credits from the industry will mean higher provision needs on the banking side.

Equity markets

The recent attack against Saudi Aramco provides us with a good example of the impact on equities when sudden shift in supply and demand economics hit the black gold; indeed, stock markets in Europe fell 0.6% on the back of the news and may worsen if the supply shortage is prolonged which we believe is likely to happen with MARPOL around the corner. Companies highly dependent on imports and exports and those all along the supply chain, may suffer in the middle term, at various levels. The increase in freight prices might have a strong impact on sales and/or on variable costs if companies are not able to pass on some or all of the increased costs to their clients. Since the shipping industry is at the heart of the global economy, every industry could see an impact on their net earnings either directly or indirectly.

CONCLUSION

These concerns add to the existing pressure on the global economic model due to environmental metrics and to the geopolitical risks such as the Brexit, the internal political risks with the rise of nationalisms and the rise of protectionism with a global trade war since the 2008 crisis. In a fragile political and economic context, IMO 2020 may just be the last ingredient to turn a cloudy weather into a storm.